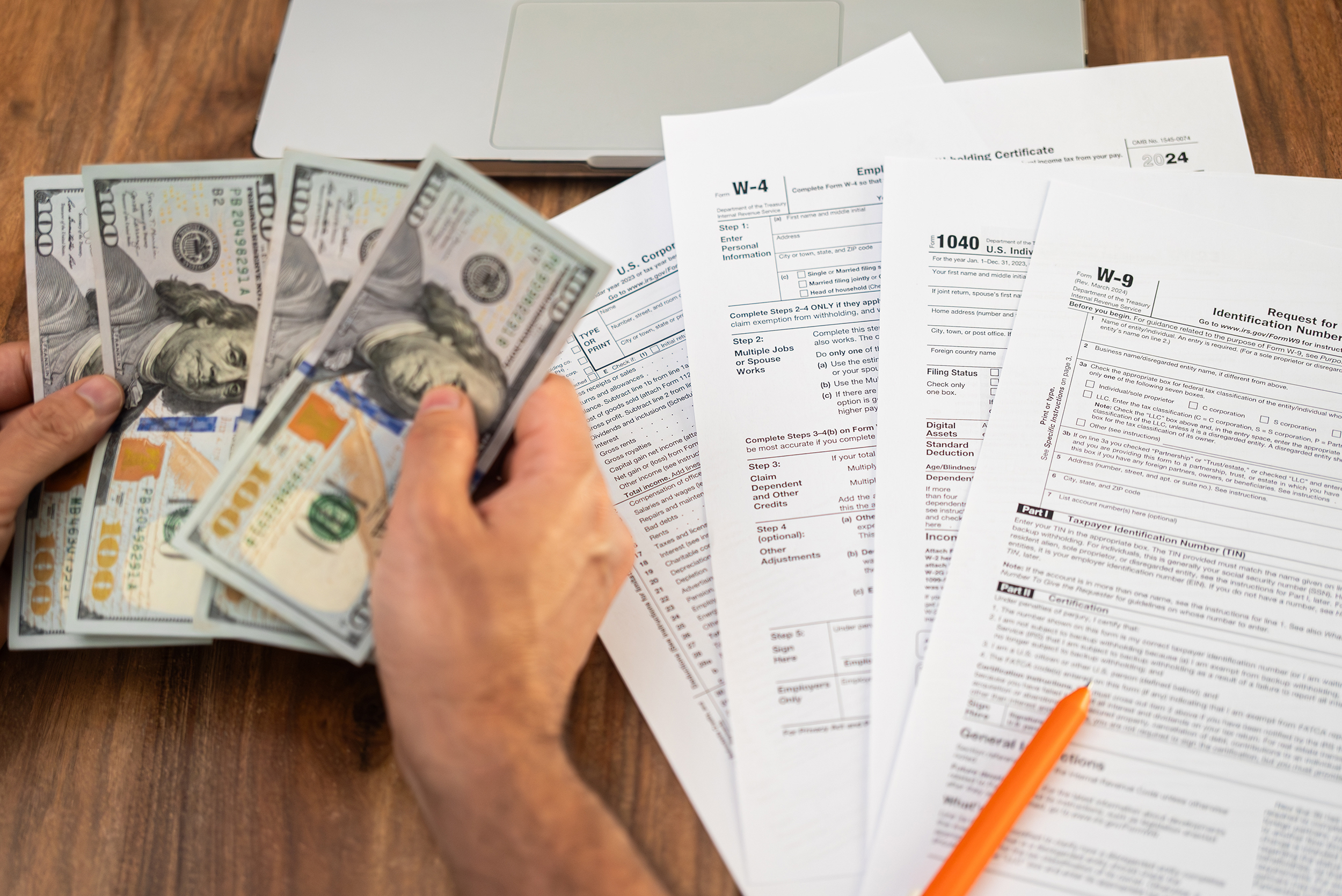

Tax season is in full swing, and the April deadline is fast approaching. If you haven’t filed yet, don’t panic – there’s still time to get organized and submit your return without last-minute stress. With the right approach and resources, you can tackle your taxes confidently and avoid costly mistakes.

By now, you should have received all your necessary tax forms, like W-2s, 1099s, and student loan interest statements. Take a few minutes to gather everything in one place, including any receipts for deductions or credits. Staying organized now can help prevent errors and delays in your filing.

Maximize Your Deductions and Credits

If you’re a student or recent graduate, don’t miss out on education credits like the American Opportunity Credit or Lifetime Learning Credit. If you’re working, look into deductions for work-related expenses, home offices, or retirement contributions. Every little bit helps when it comes to reducing your taxable income.

Choose the Best Filing Method for You

With just a few weeks left, efficiency is key. Online tax software can help simplify the process, and some offer free filing if you meet income requirements. If your tax situation is more complex, consider reaching out to a tax professional now before the rush intensifies.

File ASAP to Avoid Last-Minute Issues

The earlier you file, the better. Waiting until the last minute increases the risk of errors, delays in refunds, or even tax fraud attempts in your name. If you owe taxes, filing sooner gives you time to prepare your payment instead of scrambling at the deadline.

Need More Time? File for an Extension

If you’re truly not ready, you can request an extension to push your deadline to October. Keep in mind, however, that this only extends the time to file – not to pay. If you expect to owe taxes, making an estimated payment now can help you avoid penalties and interest.

The tax deadline is right around the corner. Whether you’re filing solo, using tax software, or seeking professional help, act now to make the process smooth and stress-free. Your future self will thank you!